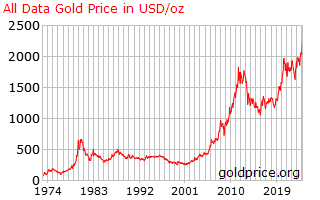

Gold is trading at record highs, with spot prices exceeding $2250 per ounce as I write this.

The chart above might lead you to wonder if you should be investing in gold. In this post, we address two related questions:

- Is gold an investment?

- Does gold belong in a portfolio?

We’ll first give you the answers, offer brief explanations, and then tell you how you can learn more.

Is Gold an Investment? – Yes and No

The No Argument

The argument that gold is not an investment is simple: Gold is not an investment because you cannot expect it to grow in real terms over time, and because it does not generate a dividend or similar cash flow. This denial that gold is an investment depends largely on the definition of an investment.

The modern guru of investments, Warren Buffet, has stated that gold is NOT an investment. He has reportedly said:

“Gold gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”[1]

This is essentially the argument that John Maynard Keynes implied when he claimed that gold is a “barbarous relic.”

I find it odd that men as obviously brilliant as Buffet and Keynes fail to perceive that gold does produce value.

Value is not an objective property. Value exists solely in the minds of people. Nothing has “intrinsic value” in economic terms absent reference to humans (or theoretically other beings) who value it. And items do not have to be tangible to be of value.

Yes, gold is tangible. And it is obviously true that gold does not grow or multiply in a physical sense.

So, in the sense of gold creating more physical ‘goods’, it is not an investment. But gold can still create ‘value’ – as we’ll now see.

The Yes Argument

The argument that gold is an investment relies on empirical observation that it has been valued for millennia.

Why have people been “digging gold out of the ground” since before history, and prizing it?

Unless we want to argue that most people in most places at most times have been stupid or irrational, we must believe that gold has been valued by people.

Why has gold been valued? The most likely reasons are that gold has properties that render it desirable in human affairs.

Those properties are largely physical. Gold is rare. Gold is malleable. Gold is almost indestructible (it reacts with very few substances found in nature). Gold is useful as jewelry because most people find it pleasing to look at. Gold is useful in certain industrial applications because of its ductility, conductivity, resistance to tarnishing, reflectivity, and malleability.

The utility of those properties made gold valuable. And that value in all probability led to gold becoming money thousands of years ago.

It is an observable fact that in most places at most times, gold has been considered valuable.

But an item being valuable doesn’t make that item an investment.

To be an investment, an item must produce additional value, while retaining (more or less) its original value. For example, productive land is an investment because each year you can grow crops on it, and the land itself retains its value.

But land that cannot be used for anything is not an investment, because even though it will still be there in the future, it produces nothing.

That raises the question with regard to gold: does gold produce anything for the owner?

Myron Scholes vs. Warren Buffett

I first heard an answer to this question from Myron Scholes, the 1997 Nobel laureate in economics, when I had the good fortune to take a course from him at Stanford in the 1980s. Scholes offered the opinion that people held gold because, on average, they expected the future return to be sufficiently positive that gold, when held as part of a portfolio, would end up as part of the efficient portfolio.

Scholes said that in about 1985. The average gold price in 1985 was about $317 per ounce. From then to now, the compound annual return on gold has been about 5%.

I think Scholes is right and Buffett is wrong.

What gold produces can be thought of in several ways. In conventional thinking, gold is a “safe haven”, an “inflation hedge,” a “store of value,” or a “portfolio diversifier.”

Does Gold Belong in a Portfolio?

Indexing

Most retail investors own little or no gold. It is believed that about half of the world’s gold is in the form of jewelry, and that private investors and governments, in roughly equal proportions, are the largest non-jewelry holders of gold.[2]

All the gold in the world is estimated to have current market value of about $15 trillion.

That compares to total global stock market cap on the order of $110 trillion, total global bond market cap of perhaps $140 trillion, total global real estate market cap of something like $350 trillion[3] and total global M2 of something like $87 trillion.[4]

It is difficult to estimate the total market value of the world’s closely held businesses, but based on US estimates and extrapolating from the US’ share of the global publicly traded markets, we estimate something in the neighborhood of $50 trillion.

If you’re an indexer, and you leave real estate out (most of the real estate is privately held residences, which are more consumption than investment), you’d have an index argument for owning a few percent of a portfolio in gold.

Efficient Portfolio

If you believe in the efficient market hypothesis and mean-variance optimization (e.g. the Markowitz model), many observers seem to say that you should have between 1% and 10% of your portfolio in gold.

The problem with using mean-variance optimization to determine a gold allocation (or any other allocation) is that the weights are very sensitive to the assumptions about return, volatility, and correlation with other asset classes.

Further Reading – Free Offer

Wiley is publishing The Investor’s Dilemma Decoded, by my daughter Katherine and me. Chapter 6 is about the investment merits, or not, of gold and gold stocks. For a free copy of that chapter, please email us at [email protected], or call 703 437-9720.

If you’re an advisor, you’ll also be interested in Chapter 14, which explains how financial advisors add value for their clients. You can also ask for that chapter.

Best,

Roger

[1] https://quoteinvestigator.com/2013/05/25/bury-gold/ can’t find proof that Buffet actually said this, but reports on the colorful history of the sentiment.

[2] https://www.visualcapitalist.com/sp/chart-how-much-gold-is-in-the-world/

[3] https://www.costar.com/article/135327380/total-value-of-global-real-estate-hits-3977-trillion

[4] https://en.macromicro.me/charts/3439/major-bank-m2-comparsion

Leave a comment