Many financial advisors work hard to grow, or to stand out in a crowded marketplace. A select few are discovering how to grow more easily, and stand out from the competition, by implementing a “blue ocean” strategy. Blue Ocean Strategy is the name of one of the most famous articles in the history of the Harvard Business Review. This is the strategy that allowed Henry Ford to establish Ford Motor Company, allowed Peter Cuneo to take Marvel from bankruptcy to a $4 billion sale in ten years, and allowed Sara Blakley to become a self-made billionaire by age 41. The blue ocean strategy for growing a business is the strategy of “creating and capturing uncontested market space, thereby making the competition irrelevant.”[1]

Blue Oceans and Red Oceans

Most well-established industries, including financial advising, law, accounting, and life insurance, are rife with competition. It’s hard for firms to stand out. They compete in a “red ocean of bloody competition,” i.e. the existing market.

Firms want to find or create a blue ocean market, because there the emphasis is more on serving clients or customers, and less on bloody, costly competition. Kim and Mauborgne present the following table comparing red oceans and blue oceans.

| Red Ocean | Blue Ocean |

| Compete in existing marketspace | Create uncontested market space |

| Beat the competition | Make the competition irrelevant |

| Exploit existing demand | Capture and create new demand |

| Make the value-cost trade-off | Break the value-cost trade-off |

Blue and Red Oceans for Financial Advisors

Most financial advisors operate in red oceans. Those advisors often find themselves pursuing prospects who already have an advisor. Or, a prospect has several advisors vying for the same business. For example, if a prospect has a liquidity event coming up, that prospect might be approached by three or more advisors. It would not be unusual for the prospective client to perceive all of these advisors as “the same” and to perceive their plans as “the same.”

But what if an advisor could drive the liquidity event? What if an advisor could show the client (or prospect who then becomes a client) how to gain the advantages of the liquidity event while avoiding the often heavy tax consequences that accompany such events? That advisor would be in a blue ocean.

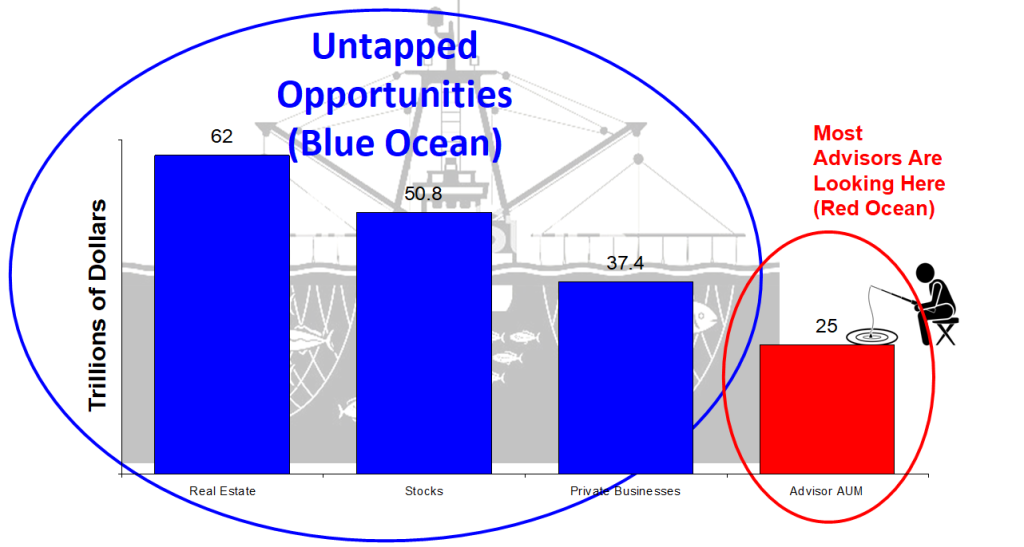

Or, consider that an advisor already has clients who have significant assets that are no advisor’s AUM. There are literally trillions of dollars of such assets, mostly in the form of investment real estate, businesses and pieces of businesses, and concentrated stock holdings.

Unlocking Assets for Clients

In many cases, asset owners act as though those holdings – of real estate, businesses, and concentrated stock – are locked up, or inaccessible to the advisor. One big reason for the “lock up” is the capital gains taxes. Advisors who can show clients and prospects how to unlock those assets, so the assets can be redeployed to better suit the clients’ needs, can operate in a blue ocean.

How Sterling Helps Advisors Access Blue Oceans

Sterling’s expertise is in helping our advisor partners grow assets under management, and grow the value of their businesses, by accessing markets and assets that other advisors are not competing for. Sterling provides partner advisors with the tools, the know-how, and the implementation capability that allow advisors to unlock those assets for their clients. In the process, those assets become the advisor’s AUM, and will remain AUM for the long run

We provide the tools, mainly from the charitable planning space; we have the know-how from over twenty-five years in the space; and we have the turnkey implementation capability to make it easy for our advisor partners to implement solutions. In these ways, we help our partner advisors grow their businesses faster, more easily, and in bigger chunks, than they ever could before.

Let’s Have a Discussion

If you’d like to learn more, we’d like to talk with you. You can reach us by phone or email. Email Roger at [email protected], or Katherine at [email protected], or call 703 437 9720.

[1] Blueoceanstrategy.com

Leave a comment